Table of Contents

- Hate Cannot Drive Out Hate Only Love - Edee Nertie

- Essential Tax Return Checklist 2024 Excel Template And Google Sheets ...

- Essential Tax Preparation Checklist For 2024 Excel Template And Google ...

- New Tax Rates 2024 25 - Image to u

- Tax Free Weekend 2024 Texas Back To School - Edee Nertie

- Child Income Tax Credit 2024 Amount - Edee Nertie

- Efficient Tax Preparation With H&R Block Checklist Excel Template And ...

- Calendar 2025 With Weeks South Africa Pdf - Edee Nertie

- Streamline Tax Preparation With 2024 Tax Preparer Checklist Excel ...

- 2024 Grammys Channel 6 - Edee Nertie

Why Estimate Your Taxes?

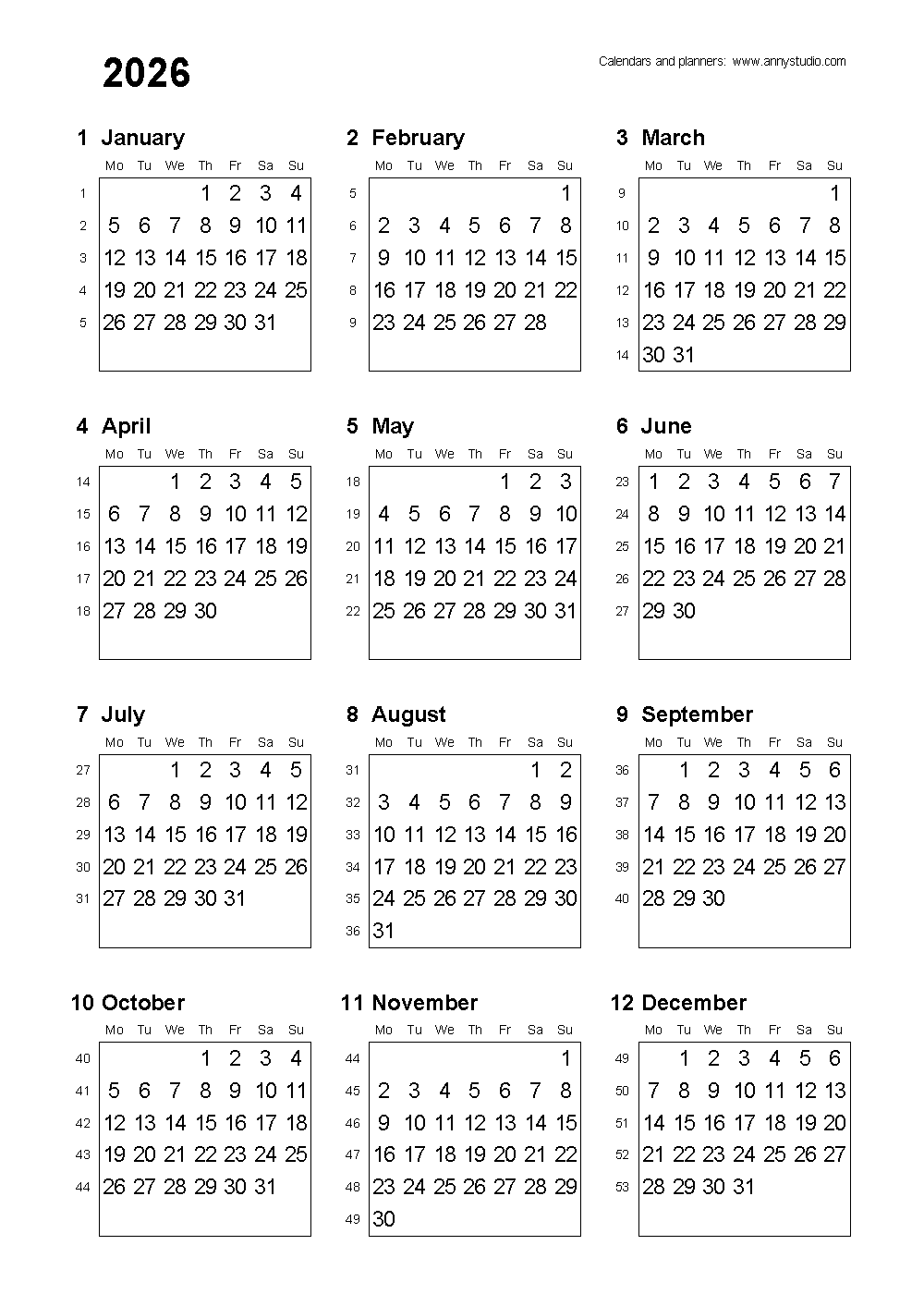

How to Estimate Your 2026 IRS Taxes

Plan Your Tax Return

Once you've estimated your taxes, it's time to plan your tax return. Here are some tips to help you make the most of your tax return: Take advantage of tax credits: Claim tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, to reduce your tax liability. Maximize your deductions: Claim deductions, such as the standard deduction or itemized deductions, to reduce your taxable income. Contribute to a retirement account: Contribute to a retirement account, such as a 401(k) or IRA, to reduce your taxable income and save for the future. E-file your tax return: E-file your tax return to ensure faster processing and direct deposit of your refund. Estimating your 2026 IRS taxes and planning your tax return now can help you avoid last-minute stress and ensure you maximize your refund. By following the steps outlined in this article and taking advantage of tax credits and deductions, you can make the most of your tax return. Remember to e-file your tax return to ensure faster processing and direct deposit of your refund. Take control of your finances today and get ahead of the game by estimating your taxes and planning your tax return.Start planning your tax return today and ensure a stress-free tax season. Visit e-File to estimate your taxes and e-file your tax return.